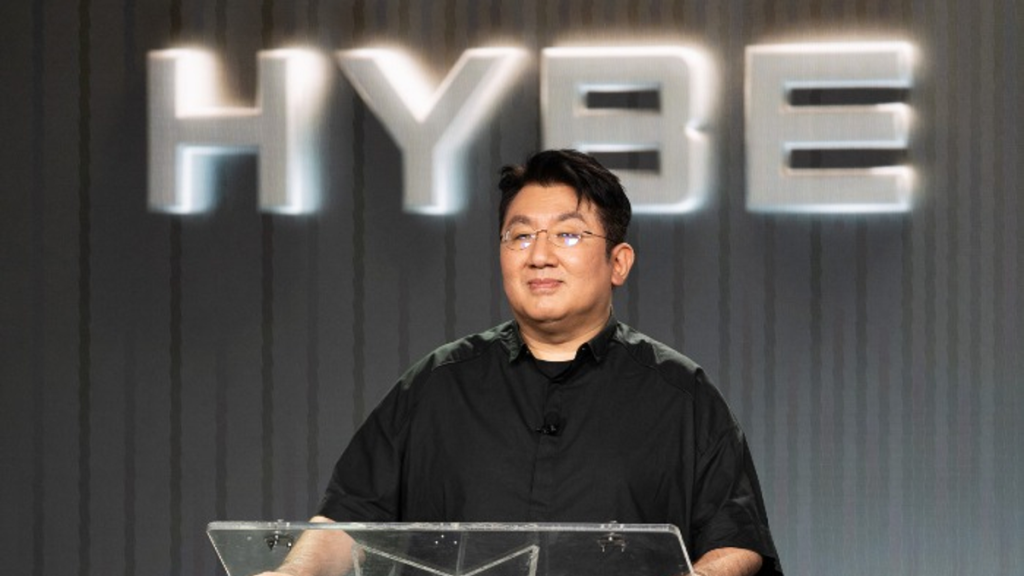

Hybe Chairman Bang Si-hyuk Under Investigation for 400 Billion Won IPO Side Deals

Bang Si-hyuk, chairman of Hybe, is facing scrutiny over 400 billion won earned through previously undisclosed IPO side deals with private equity firms in 2020.

Bang Si-hyuk speaking at podium

The controversy centers around shareholder agreements Bang signed with multiple private equity firms, including STIC Investments, Eastone Equity Partners, and Neumain Equity. These agreements included a 30% profit-sharing clause if the IPO succeeded, information that wasn't disclosed during the listing process.

Key details of the agreements:

- STIC Investments acquired 3.46 million Hybe shares in 2018

- The agreements included profit-sharing clauses triggered by a successful IPO

- Legal teams deemed the agreements private and not requiring disclosure

- Private equity firms' share sales represented only 1.7% of first-day trading

Market impact:

- Hybe's stock price increased 150% on the first trading day

- Share price dropped 60% within a week

- Opening price was 135,000 won

- Total first-day trading volume: 11.17 million shares

Industry insiders explain the agreements were made considering BTS's expected military service, with private equity firms requesting put options as protection for their long-term investment. Multiple law firms reviewed the agreements and determined no legal disclosure requirements were violated.

The controversy continues to develop as regulatory bodies examine the implications of these undisclosed agreements, highlighting the need for greater transparency in high-profile IPOs.

Elton John wearing tinted medical glasses

Coachella crowd at night

Related Articles

Duetti Secures $200 Million in Debt Funding, Reaches $435 Million Total Capital for Music Catalog Expansion